With this test, you can assess the risk of potential false self-employment for you as a freelancer working for a client. Our tool can only provide a general initial check, but it does not provide a final assessment and does not replace legal advice in a specific case.

Determine your risk of false self-employment

Learn through our test whether you could be false self-employed, and avoid legal issues.

1. Answer questions

Answer typical questions from practice that help you determine your risk. It only takes 7 minutes.

2. Receive results by email

Then you will receive an evaluation as a PDF in your inbox. There you will find all your answers again for reference.

3. Save and store

Share the results with your client or file them for the event of an audit.

Stay on the safe side with 9am

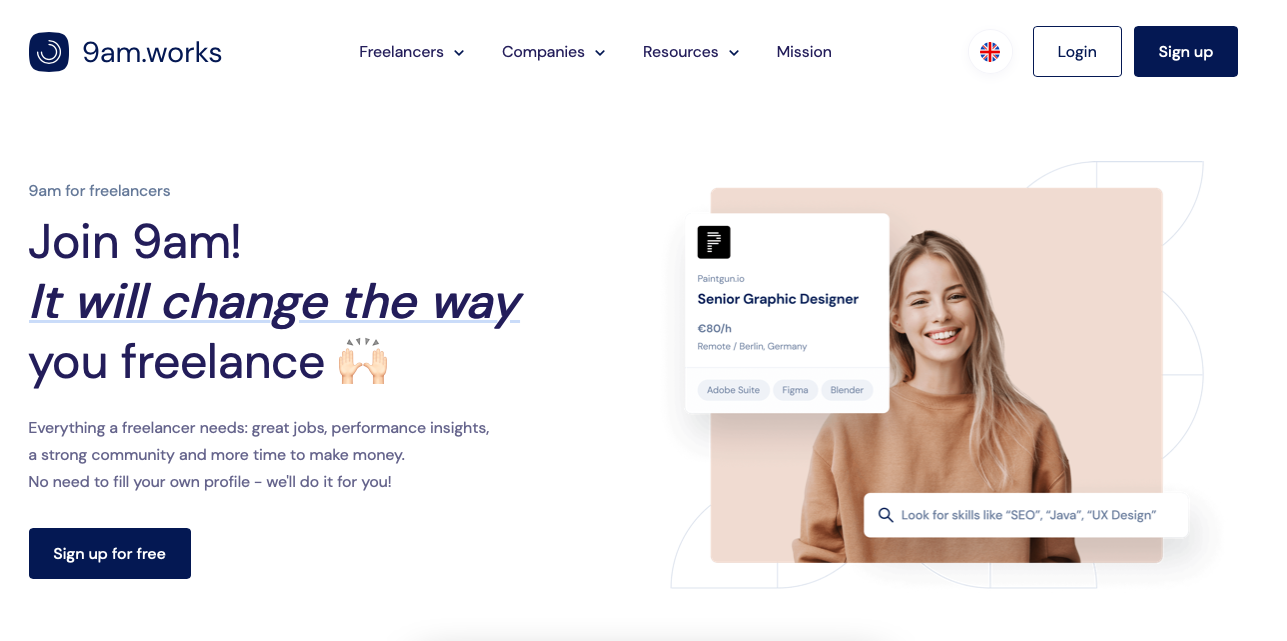

What is 9am?

Free freelancer platform with many features:

Finding and managing projectse

Attract customers with a smart profile, browse open projects and manage all contacts centrally in one place.

Contracting and tax advice

Easy contracting with contract templates created by labor law experts and free tax advice.

Knowledge and community

Webinars, events, knowledge base and networking with other freelancers.

Learn about false self-employment.

False Self-Employment as a Freelancer:

What You Need to Know

The topic of false self-employment often causes concern and uncertainty among freelancers. But it is not that complicated.

If you keep a few things in mind, you'll stay on the safe side and make sure that neither you nor your clients get into legal trouble.

Read more in the article.

Frequently Asked Questions

Here you will find answers to some questions about false self-employment.

What is false self-employment?

False self-employment means that a freelancer is treated like an employee by a client. They must take care of their own health insurance and don’t receive paid vacation or sick days, but are integrated into the company's processes and work according to instructions.

Why is false self-employment a problem?

False self-employment is contrary to the welfare state principle and is therefore pursued by institutions such as the German Pension Insurance. Among other things, clients must pay social security contributions in arrears and, in the case of intentional behavior, can even face a fine or imprisonment.

What are the consequences for freelancers in the case of false self-employment?

The consequences are less severe for freelancers than for clients, but they also have to pay back wage tax and are affected by a reversal of the sales tax paid. In addition, they can sue for a permanent position with the client.

How can freelancers avoid false self-employment?

Freelancers should make sure to work as autonomously as possible and to be involved in the client's processes as little as possible. They should provide their services independently and not receive any direct instructions. Further information can be found in this article.