Avoid False Self-Employment: Tips for Clients

In a more flexible working world, more and more companies are working with freelancers. Avoiding false self-employment in Germany (where it is called Scheinselbstständigkeit) is therefore also becoming an important issue for more clients. After all, there are serious consequences if it is detected during an audit. In this article, we explain which factors need to be taken into account.

False Self-Employment: What is That Anyway?

False self-employment, also known as bogus self-employment, is when a freelancer works for a company as a self-employed person, but in practice is treated like an employee. This can be the case, for example, if they have to adhere to a specific working schedule and coordinate their vacations with the client. With false self-employment, companies don’t pay social security contributions and don’t follow labor law regulations, although this would actually be necessary in their case.

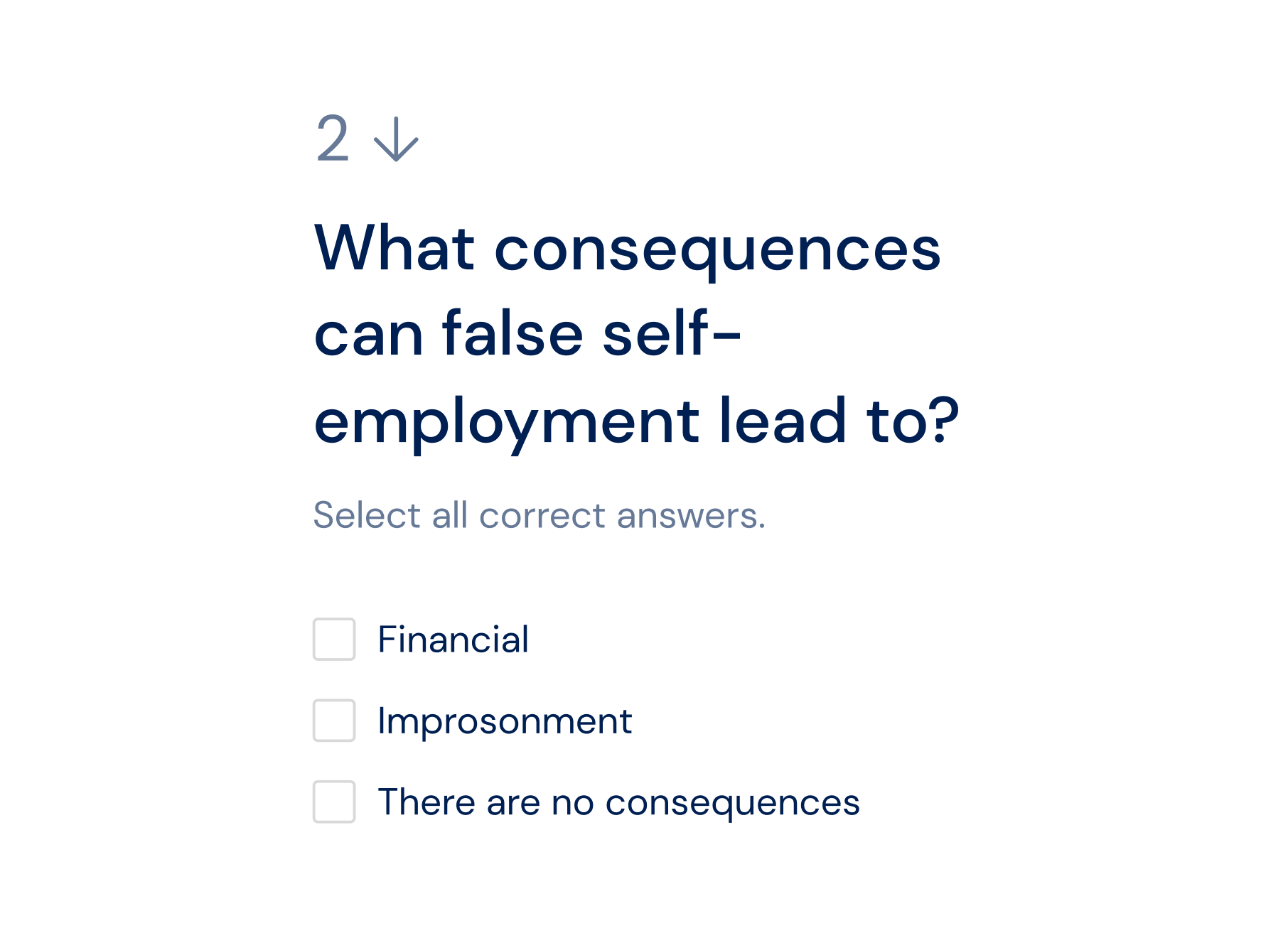

There are audits done by several German official institutions to uncover these employment relationships. This usually results in additional payments for social security contributions as well as taxes. In addition, penalties can be added for the client. That would obviously be very negative and should be avoided. In our article "False Self-Employment: Consequences for Clients", we go into more detail about the possible consequences.

Avoiding False Self-Employment from the Start

If you want to avoid false self-employment, you should first and foremost ensure that the freelancer is not treated like an employee. The assessment always depends on the individual case, but the following tips can help in keeping the risk low:

Project-related Assignment

The freelancer is entrusted with very specific tasks that are clearly defined and often also limited in time. They work independently of instructions and do not, like an employee, take on other activities or routine company-internal tasks as needed. In addition, they do not regularly attend internal meetings that have nothing to do with their project.

Several Clients

The income of a self-employed person is composed of various jobs. Freelancers are not restricted in the selection of their assignments. Therefore, the contract should never state that the freelancer is not allowed to work for other clients at the same time. As a rule of thumb, the German Pension Insurance (Deutsche Rentenversicherung) states a share of five sixths of the income that a freelancer may achieve through one client at the most.

Independent Organization

Freelancer organize their work themselves according to their own preferences and processes. Of course, agreeing on deadlines is not a problem, for example, but the client cannot dictate exactly how tasks are to be completed.

Independence of Working Hours and Vacations

.It doesn’t matter for the freelancer's work when they perform it. They don’t have to adhere to shift schedules or to be available during the company's core working hours. If they like to work nights or weekends, that's their business. They also don’t have to coordinate their vacations with the salaried employees. However, timely information about longer absences is of course not a problem.

Entrepreneurial Status

The freelancer bears an entrepreneurial risk and acts as a self-employed person. They offer their activities, for example, on their own website and do their own marketing. Perhaps they also employ staff or freelancers themselves. It would be especially good if they even runs a GmbH, OHG or KG.

Working on Their Own Premises with Their Own Equipment

Since freelancers are self-employed, they use their own work equipment to complete the orders and are not provided with it by the client. They also work in their own office or in a coworking space, but not on the company's premises.

Unfortunately, there is no definitive checklist on the subject of false self-employment, and it always depends on the combination of individual factors. For example, just because the freelancer drops by for a meeting occasionally and then works in the company's office, or because they use company equipment now and then, that doesn’t necessarily mean that they are a false self-employed person.

But if some of the points mentioned are unclear or not given, this is a clear warning signal. Clients should address the issue with the freelancer as soon as possible, clarify open questions and, if necessary, structure the cooperation differently.

By the way: Our false self-employment test provides an initial assessment. With just a few questions, you can determine the risk, making it easier to avoid false self-employment.

Avoiding False Self-Employment: Contract is not Enough

Many companies draw up a contract with the freelancers working for them. In it, they stipulate, for example, that the freelancers can also work for other clients, are not bound by the company's vacation schedule and can perform their work when and where they want to.

However, these agreements are not sufficient to avoid false self-employment. The decisive factor is the actual nature of the collaboration. It happens again and again that freelancers are integrated into internal processes to a greater extent than it is stated in the contract. This often happens step by step and is not always intentional. It is therefore best for clients to always remain attentive and evaluate how they actually work with their freelancers. In this way, it becomes clear in good time whether there is a risk of false self-employment.

Of course, a contract still makes sense to set out the general conditions. If you include the right clauses, you achieve clarity for both sides, and you can reduce the risk through this alone. The only thing to remember is that the contract alone is not enough to avoid false self-employment.

Security Through the “Clearingstelle” or a Consultation

Clients have another option for avoiding false self-employment: Together with the freelancer, they can turn to the “Clearingstelle” of the German Pension Insurance (Deutsche Rentenversicherung) and ask for a status determination (“Statusfeststellungsverfahren”) there. Of course, this puts the focus on any false self-employment that may exist. But this is still much better than if the pension insurance initiates the process because there is something suspicious during an audit. And if false self-employment can be ruled out afterwards, all parties involved can feel secure.

An alternative is a check by a specialized lawyer. They can examine the individual case, give an assessment and (if necessary) also provide advice and support in the further course of the proceedings.

By the way: The checklist in our article "False Self-Employment: Criteria 2022 and Checklist" provides numerous tips for a better assessment.

Learn more about Scheinselbstständigkeit